As a group, the top 50 global property/casualty insurers grew premiums by 8.3% in 2024, but four of them, individually, grew by more than 20%, including Progressive which vaulted into the top five.

S&P Global Market Intelligence earlier this month, showing Progressive Corp. jumping ahead of Lloyd’s of London Ltd. and The People’s Insurance Co. (Group) of China Ltd. Progressive recorded a 20.5% jump in U.S. GAAP-reported gross earned premiums to more than $72 billion.

Progressive Corp., is now ranked fourth on the S&P GMI’s top 50 list, with Lloyd’s staying in fifth place, and PICC dropping to sixth place from a prior fourth-place ranking).

Progressive’s 2024 growth surpassed the only other insurer in the global top 5 to record a double-digit jump in earned premiums—top-ranked State Farm Mutual Auto Insurance Co., which retained its first-place ranking.

But Progressive wasn’t the fastest sprinter in the top 50. Gross earned premiums for Bermuda-based RenaissanceRe Holdings Ltd. soared 31.1% in 2024, S&P GMI representatives revealed during a webinar about the global insurer rankings yesterday. With RenaissanceRe’s late 2023 acquisition of Validus Re from AIG likely impacting the growth spurt, the Bermuda reinsurer made its first appearance on S&P’s global list, landing in 44th place with roughly $12 billion in 2024 gross earned premiums.

Also growing more than Progressive were Auto-Owners Insurance Group, growing 21.7% and now ranked 40th with over $14 billion in direct earned premiums for 2024, and Arch Capital Group, with a 21% jump in gross earned premiums earning the Bermuda-based insurer and reinsurer the 29th spot in the top 50 ranking.

Also growing more than Progressive were Auto-Owners Insurance Group, growing 21.7% and now ranked 40th with over $14 billion in direct earned premiums for 2024, and Arch Capital Group, with a 21% jump in gross earned premiums earning the Bermuda-based insurer and reinsurer the 29th spot in the top 50 ranking.

Progressive, Arch Capital and Berkshire Hathaway (the second-largest global insurer) were also listed among the top 10 insurers on a separate S&P GMI ranking published in July——an annual ranking of the 100-largest U.S. P/C carriers based on key performance metrics gauging superiority of rates of return, underwriting profitability, balance sheet growth and other indicators of success.

(Editor’s Note: Kinsale Insurance, Assurant and Intact Financial Group were the top three performers according to the July ranking.)

Related: (S&P GMI); (2023 Performance); (2023 Performance)

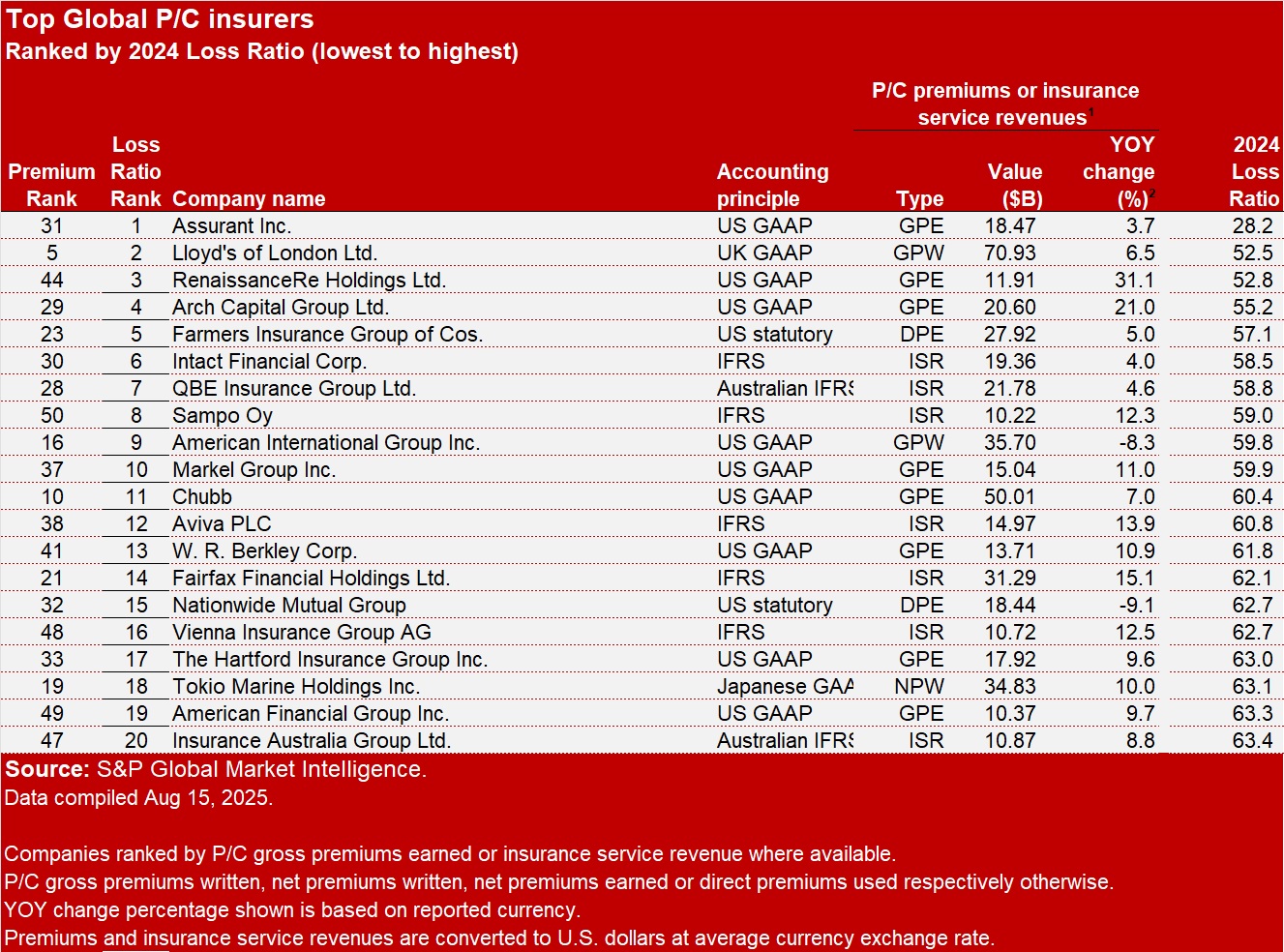

Accompanying the latest list of the 50 biggest global P/C insurers, S&P GMI analysts provide one measure of performance—the 2024 reported loss ratio. Across the top 50, the 2024 loss ratio averaged 64.3, improved from a 66.8 average loss ratio in 2023, S&P GMI representatives said during the webinar presentation.

Below, Carrier Management extracted a list of the 20 global insurers with the lowest 2024 loss ratios among the top 50 (presented in order from lowest loss ratio to highest).

While growing global players RenaissanceRe and Arch Capital appear high up on this list, neither Progressive nor the largest carrier, State Farm, had particularly low loss ratios in comparison to other large global insurers. S&P GMI reports State Farm’s 2024 loss ratio at 78.2—making it the worst among the 44 large insurers for which loss ratios were available. S&P GMI reports a 69.1 2024 loss ratio for Progressive, which would give it a 31st place ranking on the full list sorted by ascending loss ratio.

Presenters during yesterday’s webinar spent a good amount of time describing the complexities of putting together a global list of the largest insurers, first explaining why they publish separate lists of the biggest global life and biggest P/C insurers. For example, while P/C carriers would dominate a list based on premiums, life insurers with long duration liabilities would dominate a list based on life/health reserves, they noted.

Another complication in compiling rankings has to do with different accounting principles in various regions covered by the analysis—U.S. GAAP and U.S. Statutory for companies headquartered in the United States and Bermuda on the list, and IFRS for the others.

The Top 50 list published by S&P GMI indicates the accounting principle used for each insurance company. Where possible, P/C companies are ranked by gross premiums earned or insurance service revenue (IFRS reporters). When the gross earned premium measure of size was unavailable, S&P GMI analysts substituted P/C gross premiums written, net premiums written, net premiums earned or direct premiums earned, respectively.

According to S&P GMI, P/C insurance companies in North America made up over half of the top 50 global P/C insurer list. S&P GMI representatives also noted that 14 European insurers and a dozen headquartered in the Asia Pacific region made the list.

For the most part, the P/C list tells a growth story, with 48 of the top 50 reporting higher levels of premium or revenue for 2024 over 2023. The only two P/C insurers for which S&P GMI showed declining volume were AIG—representing the flip side of the RenaissanceRe growth story with its sale of Validus—and Nationwide Mutual Group.

Other notable moves on the list included Allstate and Liberty Mutual switching places among the top 10 (Allstate is now ranked eighth, and Liberty ninth), and Zurich and Ping An switching places just beneath them. Zurich Insurance Group now ranks 11th.

During the webinar, S&P GMI also presented a list of eight companies that garnered spots on both the Top 50 global P/C and Top 50 global life insurer rankings, with Zurich and Ping An among them. Allianz SE had the highest ranks among those on both lists—positioned third on the P/C list and second among life insurers.

Topics Carriers

Was this article valuable?

Here are more articles you may enjoy.

Suspects in Louvre Heist in Custody After Week-Long Manhunt

Suspects in Louvre Heist in Custody After Week-Long Manhunt  Trucking App Trucker Path Launches Retail Insurance Agency

Trucking App Trucker Path Launches Retail Insurance Agency  AWS Outage a ‘Moderate Incident,’ Another Near Miss for Insurance Industry

AWS Outage a ‘Moderate Incident,’ Another Near Miss for Insurance Industry  World’s Largest Retirement Community Taps Muni Market to Help Build More Homes

World’s Largest Retirement Community Taps Muni Market to Help Build More Homes